Insurance coverage can be one of the most important pillars of your retirement plan. It is also one of the most personal.

Insurance coverage can be one of the most important pillars of your retirement plan. It is also one of the most personal.

Policies vary as widely as the people who purchase them, and coverage requirements can change dramatically as we age.

In the United States, anyone aged 65 or older qualifies for Medicare, a federal health insurance program. In addition, certain disabilities and illnesses qualify an individual for Medicare.

Transitioning from a private, marketplace or company-sponsored insurance plan can be confusing. We always recommend checking with a licensed insurance professional before making such an important decision.

Beyond that, here are four things to consider as you plan your coverage:

- Can you keep your current insurance coverage when you retire?

- Read the fine print of any policy you choose. Check the cost of your premiums, deductibles and any hidden costs. What will you pay out-of-pocket for hospital stays or doctor visits? Is there a yearly limit on what you could pay out-of-pocket for medical services? Make sure you understand any coverage rules that may affect your costs.

- Does your plan include your preferred provider? Will you need additional coverage for costs associated with vision, dental and/or hearing? Are the doctors in your plan or network accepting new patients?

- Prescription drugs. Do you have prescription drug coverage? You may face a penalty if there is a gap between your eligibility date and application for coverage. How much coverage will your prescription drug plan offer for the medicine you require? Are you eligible for a free Medication Therapy Management program?

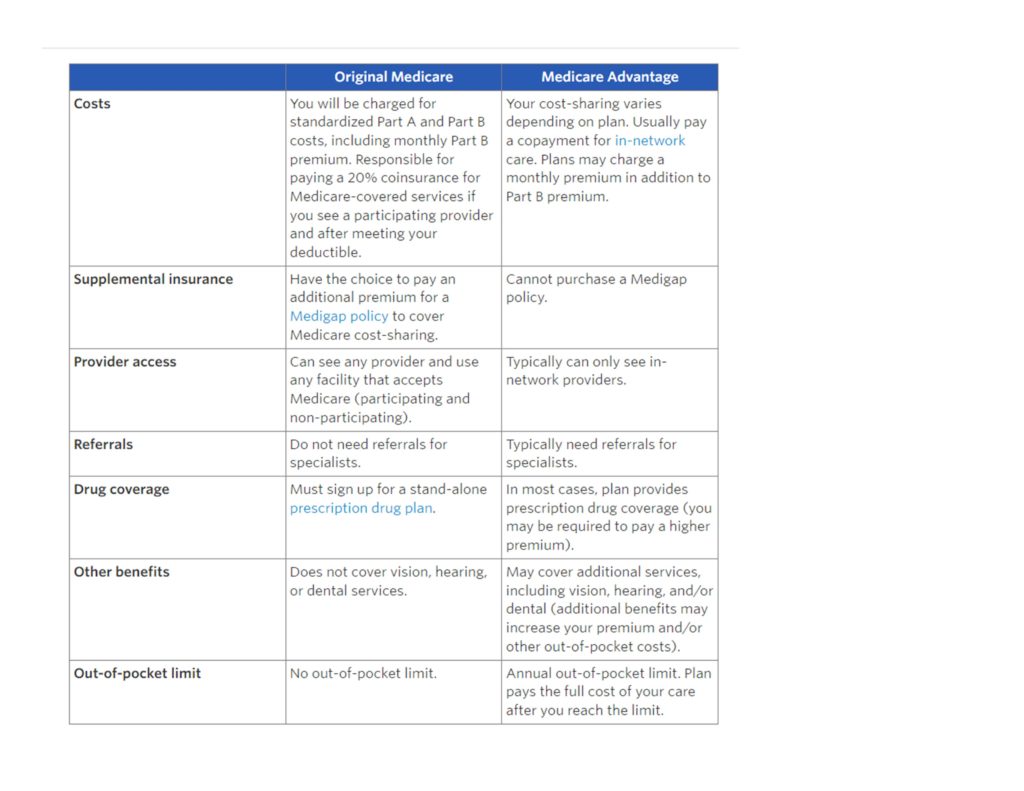

People with Medicare can get their health coverage through either Original Medicare plus supplements or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

The following chart from the Medicare Rights Center illustrates the differences between the two plans:

If you have any questions regarding your Medicare options, please contact us. Our in-house insurance department would be glad to walk you through your options.