The S&P 500 is the most widely recognized index to represent the overall stock market. Once again we find ourselves in familiar territory.

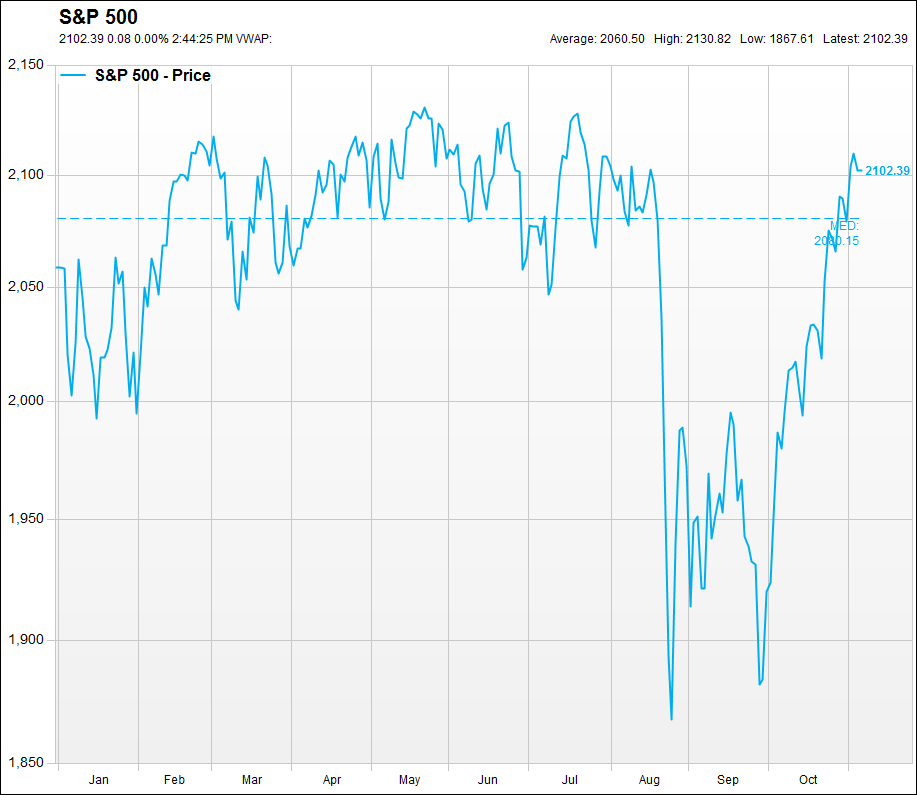

The S&P 500 is right around 2100 yet again. In the past, this level (or a tad higher to be more precise) has represented a challenging level for the market to surpass. What is in store this time? It is our belief that the market might find the usual struggles again in gaining much ground above the 2100+ level.

Earnings season is almost complete and while this quarter did not present too many time bombs, we witnessed a lot of companies reining in their forward outlooks. The most common excuses were:

- Slowing global economy

- Slowing emerging market growth

- Low oil prices.

Unfortunately we see all three excuses not going away anytime soon. In fact, some of these problems continue to get worse.

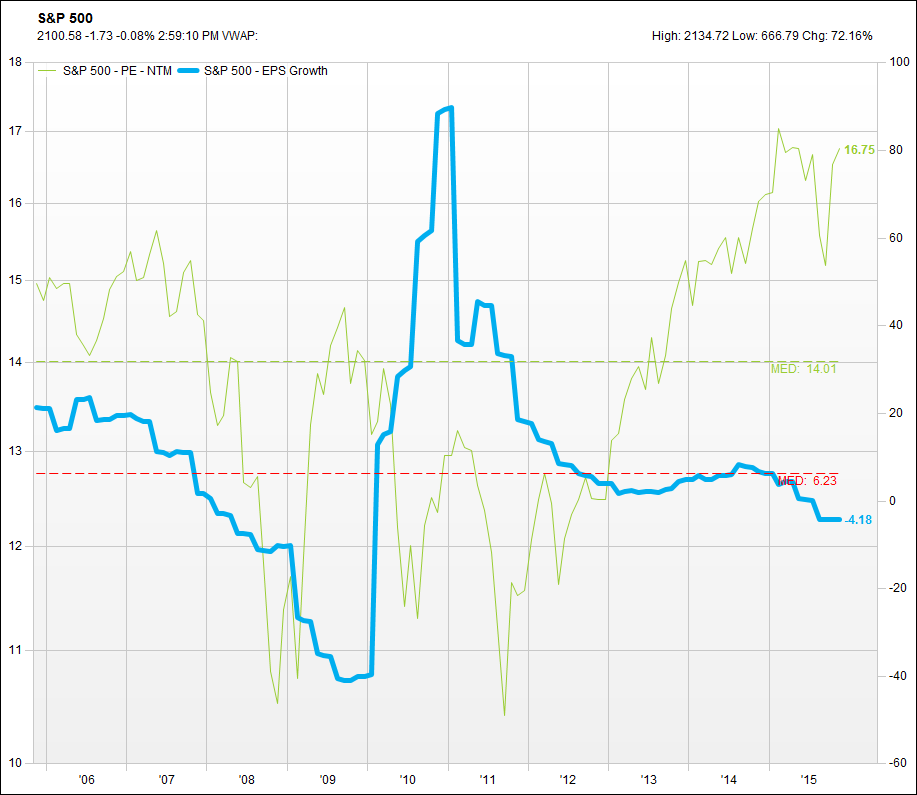

Also, with Fed. Chair Janet Yellen, increasing the rhetoric around expecting a rise in interest rates, this might add another obstacle to further market upside. As we mentioned before, the most important reason for our more conservative tilt is valuation and lack of earnings per share growth. Indeed as the second chart illustrates, we are looking at the market selling at a market premium to historical multiple averages. At the same time earnings per share growth over the next twelve months is expected to be negative.

Thus, we would not be too surprised to see the market struggle once again at this familiar 2100ish territory.