Client Services

Like many, I have certain expectations of camping. Hard ground. Hot food. Cold drinks. The simple things in life. I certainly do not expect an eye-opening conversation about tax codes and retirement policies. So, when the topic came up this last weekend around a campfire, I was quite surprised.

One of my friends, generally very astute, was convinced that there was no reason to invest in a traditional IRA. A Roth, she told us, was just plain better. Why pay taxes when you don’t have to?

I tried to interject to give an even-handed comparison. “They are different plans,” I protested, “for different circumstances. Neither one is always better.”

My friend ignored me. She continued. And I was amazed.

A Roth, it turns out, is no mere retirement account. It can hold stock in Apple and Microsoft. It compounds in value every nanosecond. It’s gluten free. Bluetooth compatible. Standard and metric. Faster than a speeding bullet.

My account is slightly exaggerated. Well, borderline untrue. Fine – a complete and utter fabrication. But hearing the way many people, my friend included, talk about Roths, it doesn’t seem all that far-fetched

Let’s be clear: there are many advantages to a Roth. The funds can be withdrawn or transferred with relative ease. It is more flexible in estate planning. It is not subject to a required minimum distribution at age 70. And it can save money in the long run, depending on your tax situation.

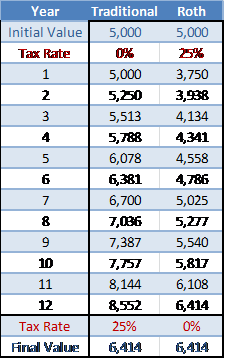

But that is the key: depending on your tax situation. Roth IRA contributions are included in your taxable income, while traditional IRA contributions reduce it. All else being equal, the person who uses a traditional IRA will be able to invest more in their plan than the person who uses a Roth IRA, because their tax load is lower. Assuming both plans are invested identically, with similar tax brackets in retirement, the traditional IRA will have exactly as much post-tax value as a Roth. You can see this in the accompanying table.

However, life isn’t a table. There are many different variables that can skew the numbers.

However, life isn’t a table. There are many different variables that can skew the numbers.

The first is basic statistics: people tend to spend less in retirement. A study by the Center for Retirement Research found that spending by retirees drops 2.5% at retirement and continues to drop inflation adjusted 1% a year. This stands to reason: Medicare covers health insurance; work-related expenses cease; and more time can be devoted to cooking meals. And if you spend less in retirement, a Roth is a losing deal, because you paid more in inflation-adjusted taxes while you were working than you would have in retirement.

But of course that doesn’t tell the whole story: many of the deductions and exemptions that people benefit from while working disappear after they retire. Children are no longer dependents. Mortgages are paid off. Travel expenses can no longer be claimed. What this means is that a retiree’s effective tax rate may be higher in retirement despite having lower expenses.

Building on this: your personal situation matters quite a bit in deciding between the two. If you’re struggling with debt and financial problems in the present, it can make more sense to take the immediate benefits of an IRA deduction. Having a tax-free retirement account provides little-to-no value to someone who can only afford to withdraw $5,000 a year. On the other hand, if your finances are secure and you want a nest egg that’s as large as possible, then a Roth is a no-brainer. It gives far more flexibility and control, making it much simpler to put your money where you want to, when you want to.

Where you plan on retiring is an important consideration as well, especially if it is a different state than where you are currently working. Remember, a Roth is taxed while you are contributing, and a traditional IRA is taxed when you are withdrawing. This means an electrician working in Texas (where there is no state income tax) who plans on retiring in Oklahoma (where it is 5.25%) has every reason to use a Roth. He is saving five cents on every dollar when he starts withdrawing. Conversely an accountant living in Oklahoma hoping to spend her golden years in Texas is better off contributing to an IRA. The tax deferral effectively becomes a tax write-off when she moves to the Lone Star State. Generally speaking, it makes sense to compare your state’s income taxes to the national average before deciding whether or not a Roth is preferable.

We shouldn’t forget politics either. No one knows where tax rates will be 20 years from now, but we can make a reasonable guess that they won’t be going down. Debt to GDP is at historic highs (excluding World War II). Tax rates are below historic norms. Millions of baby boomers are entering retirement each year. These factors all point to a potential increase in taxation, especially for high earners, which could make the Roth a more attractive option.

This list is far from exhaustive, but I hope I’ve made my point: there’s nothing magical about a Roth. Like a traditional IRA, it should be thought of as a tool designed to help you retire. It will grow faster if it’s better invested, not because it’s a Roth. It will give you different benefits at different times, and usually the most sensible decision is to use both a traditional IRA and a Roth to diversify your tax exposure. Having access to both helps you develop a plan that maximizes your overall retirement returns in the most cost effective way possible. Unless you want an account that’s more powerful than a locomotive. Then a Roth is definitely better.

For more information about Roth and traditional IRAs, call or email the office. With over 30 years of experience in wealth management and a proud adherence to the fiduciary standard, we’re always happy help.

Note: This information is posted for educational purposes only and should not be considered investment advice. Please consult a certified financial professional with a fiduciary responsibility to his or her clients before making any investment important decisions.