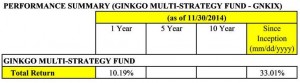

Propelled by its tactical allocation strategy, which allowed fund managers to successfully navigate market volatility, the Ginkgo Multi-Strategy Fund enjoyed especially strong performance over the one-year and three-year periods ending on November 30, 2014, which led to a four star rating by Morningstar for the three-year period ending 11/30/2014, out of 183 funds in the tactical allocation category for risk adjusted returns.

“Over the past three years, the Investment Team has really hit the cover off the ball,” said Co-Chief Investment Officer John Hintz. “The Fund has enjoyed outstanding absolute and relative total returns mainly due to our ability to effectively analyze the risk/reward tradeoff in various asset classes and market sectors. Our in-house analytical expertise, especially within the Energy and Health Care sectors, has been a large contributor to the Fund’s terrific performance over the short term and long term.”

The Fund’s ability to allocate tactically within various asset classes and market sectors led to it outperforming 91% of the 297 funds in the Tactical Allocation Category on Morningstar+ for the one-year period ending Nov. 30, 2014, and 89% of the 201 funds in the Tactical Allocation Category for the three-year period ending Nov. 30, 2014, based on total returns.

During the first half of 2014, the Fund remained significantly overweight in the energy sector, which paid off handsomely. In late June, concern regarding the potential for falling oil prices along with elevated energy sector valuations prompted the investment team to reallocate, essentially exiting the energy sector altogether.

This agile response to our investment team’s in-depth analysis allowed the Fund to participate in the energy upswing earlier this year, while, at the same time, avoiding the energy massacre that has taken place over the past few months.

In early fall, the investment team became more concerned about slowing economic growth in Europe and China in combination with elevated U.S. valuation multiples. Capitalizing on the Fund’s inherent flexibility, the team moved to a defensive allocation prior to the market correction that soon took place. As valuations in some sectors became attractive again, the team successfully took a more offensive approach with the portfolio to capture the fast recovery off the bottom.

By successfully navigating the market volatility and holding close to zero percent in the energy sector during the three month period ending November 30th, 2014, the Fund posted a positive total return of 4.77% versus its peer group of 310 funds, which posted a negative 1.17% total return.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s annual operating expenses are 1.93%.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s annual operating expenses are 1.93%.

*Past Rankings do not ensure future performance. Rankings are only one form of performance measurement. For current performance information, please call 855-289-4656.

No-load funds are sold without a sales charge, however other expenses do apply to an investment in the fund. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses. Performance shown is for Investor Class shares (please see a prospectus for information about other share classes). For performance information current to the most recent month-end, please call toll-free 855-289-4656.

+Morningstar, Inc. All rights reserved. Morningstar is an independent provider of financial information. Morningstar performance rankings are based on total return without sales charge relative to all share classes of mutual funds with similar objectives and determined by Morningstar. Past performance or ranking is not indicative of future results.

Morningstar is an independent provider of financial information. Morningstar performance rankings are based on total return without sales charge relative to all share classes of mutual funds with similar objectives and determined by Morningstar. The top 10% of the funds in a rating universe receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. Past performance or ranking is not indicative of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Ginkgo Multi-Strategy Fund. This and other important information about the Fund is con-tained in the prospectus, which can be obtained at www.ginkgofunds.com or by calling 855-289-4656 (BUY-GNKO). The prospectus should be read carefully before investing. The Ginkgo Multi-Strategy Fund is distributed by Northern Lights Distributors, LLC, member FINRA.

Mutual Funds involve risk including the possible loss of principal. There is no assurance that the fund will achieve its investment objectives.

4490-NLD-12/3/2014